Contact Us

Write to us to start cooperation or ask the

questions. We respond within 1 hour

Write to us to start cooperation or ask the

questions. We respond within 1 hour

Send us your contacts and we will

contact you within 1 hour

Send us your contacts and we will contact you within 1 hour

Last updated: 02.07.2021

The Hellenium Project and its subsidiaries (“Hellenium”, “we” or “us”) welcome you to our website, mobile applications and other services provided via electronic means (together referred to as “Electronic Services”) and appreciate your interest in our products and services. Hellenium attaches importance to appropriate data protection. This page explains how we treat your personal data in connection with your use of our Electronic Services (“Privacy Policy”). By continuing to use the Hellenium, you confirm that you are 18 years of age or older. Please note that we may amend this Privacy Policy from time to time. The applicable version is always the current one, as referenced above (last updated).

Protecting your privacy and treating the personal data of all users of our Electronic Services in accordance with the law is important to us. We understand that by using our Electronic Services you may be entrusting us with personal information (“data”)

and assure you that we take our duty to protect and safeguard this data very seriously. This Privacy Policy therefore explains the kind of data we process when using our Electronic Services, the purpose

for which we process it, how we process it, whom we may disclose it to and the security measures we have put in place to protect it.

This Privacy Policy

applies to all data we obtain through your use of our Electronic Services. It does not apply to data we obtain through other channels nor to Electronic Services of third parties (“third-party Electronic

Services”), even if you access them via a link in our Electronic Services or even if they are necessary for the operation of our Electronic Services. We have no influence on the content or privacy policy

of third-party Electronic Services and therefore cannot assume any responsibility for them.

When you use our Electronic Services, details of your usage may be automatically registered by our backend systems (such as your IP address, browser, http-header user agent, device-specific information the content you accessed, including time and date of access, usage and user interaction, and the redirecting website from which you came to our Electronic Services). We also process personal data such as your name, address, e-mail address, phone number, date of birth, gender and other data transmitted to us if you register for the usage of our Electronic Services or if you complete a registration form or comment field for a newsletter, product demos, etc..

We process the data based on the following legal grounds:

-For the performance of a contract to which you are a party or in order to take steps at your request prior to entering into a contract;

-For compliance with a legal obligation to which we are subject;

-For the purposes of our legitimate interests.

We process the data for the following purposes:

-To comply with bank’s

own internal guidelines;

-To check the identity and suitability of clients for certain products and services;

-To establish a basis for future information on the products and services offered by

Hellenium and to improve their quality;

-To facilitate technical administration, research and further development in connection with the Hellenium;

-To ensure the security and operation of our IT

environment;

-To use it for marketing and advertising measures (e.g. newsletters via e-mail, online advertising);

-To analyse and monitor the usage, user behaviour and navigation while using the Electronic Services;

-To facilitate client administration.

We process all your personal data in accordance

with the applicable laws on data protection and for as long as required.

Hellenium only discloses Electronic Services usage data to third parties as permitted by law, if we are legally obliged to do so or if such disclosure becomes necessary to enforce our rights, in particular to enforce claims arising from a contractual

relationship. Within this scope as well as for the purpose of optimising our products and services, we may transmit data within the Hellenium Group between Group companies in Switzerland or abroad. Furthermore,

we may disclose data to external service providers if this is necessary for the provision of products and services. Such service providers may not use the data for any other purpose than to process the order

in question. All of the above persons and entities that may receive data must observe the applicable national and international data protection laws as well as the data protection standards of Hellenium.

Where so prescribed by applicable legislation, Hellenium may on request or under an ongoing duty to provide information disclose data to supervisory authorities, judicial authorities or other persons

of authority.

Hellenium will make every effort to take appropriate technical and organisational security measures to ensure that your personal data processed within the IT environment controlled by Hellenium is protected against unauthorised access, misuse, loss and/or

destruction, taking account of the applicable legal and regulatory requirements.

Hellenium takes both physical and electronic process-specific security

measures, including firewalls, personal passwords, and encryption and authentication technologies. Our employees and the service providers commissioned by us are bound by professional secrecy and must comply

with all data protection provisions.

Additionally, access to personal data is restricted to only those employees, contractors and third parties who require this access in order to assure the purpose

of data processing and the provision of products and services (need to know principle).

Hellenium would like to draw your attention to the fact that if you use our Electronic Services via an open network, this may allow third parties (e.g. app stores, network providers or the manufacturer of your device), wherever they are located, to access

and process your data. Open networks are beyond Hellenium’s control and can therefore not be regarded as a secure environment. Any transmission of data via such open network cannot be guaranteed to be secure

or error-free as data may be intercepted, amended, corrupted, lost, destroyed, arrive late or incomplete, contain viruses or may be monitored. In particular, data sent via an open network may leave the country

– even where both sender and recipient are in the same country – and may be transmitted to and potentially processed in third-party countries, where data protection requirements may be lower than in your

country of residence.

Where data is transmitted via an open network, we cannot be held responsible for the protection of this data and we accept no responsibility

or liability for the security of your data during transmission. We, therefore, recommend avoiding the transmission of any confidential information via open networks.

The Hellenium use cookies for statistical purposes as a tool for our web developers and to improve the user experience. Cookies are small files which are stored on your electronic device to keep track of your visit to the Electronic Services and your

preferences; as you move between pages, and sometimes to save settings between visits. Cookies help the builders of Electronic Services gather statistics about how often people visit certain areas of the

site, and help in tailoring Electronic Services to be more useful and user-friendly.

Please note that most web browsers accept cookies automatically. You

can configure your browser to not save any or only certain cookies on your electronic device or to always display a warning before receiving a new cookie. Deactivating cookies can, however, prevent you from

using certain functions on our Electronic Services.

Please click here to let us know how we can use cookies. You can withdraw your consent at any time. These settings do not apply to Hellenium mobile

applications.

Remark: For some Electronic Services, cookies are only persistent during user session and will be deleted after the session is terminated.

We use various analysis tools from third parties such as Google Analytics for the purpose of reporting for Electronic Services. This involves the creation of pseudo-anonymised data and use of cookies to help analyse how users use our Electronic Services.

The information about your use generated by these cookies, such as the

-host name of the accessing electronic device (masked IP address)

-type/version

of browser used

-operating system

-referrer URL (website from which visitors are redirected to the Hellenium by clicking a link)

-date and time of server request

-device-specific information

may be transmitted to third party servers located in countries outside of the European Union and is used for analysis purposes.

Please click here to let us know how we can use cookies. You can

withdraw your consent at any time. These settings do not apply to Hellenium mobile applications.

Please refer to the previous section, “Cookies”, for information on deleting cookies.

The Hellenium may contain links to third-party Electronic Services that are not operated or monitored by us. Please be aware that such third-party Electronic Services are not bound by this Privacy Policy and that we are not responsible for their content or their principles regarding the handling of personal data. We therefore recommend consulting and checking the individual privacy policies or terms of use of third-party Electronic Services.

According to applicable data protection laws and regulations, you may have the following rights:

-requesting information on personal data that we hold about you,

-demanding that the information

be rectified should it be incorrect,

-asking that your data be deleted if the Bank is not permitted or is not legally obliged to retain the data,

-demanding that the processing of your data be restricted,

-objecting to the processing by us,

-transferred in a generally useable, machine-readable, and standardised format.

You also have a right of appeal (as far as this affects you) to the respective

Data Protection Supervisory Authority

If you have questions about the processing of your personal data, please feel free to contact us by using the following contact details:

Hellenium & Co. Ltd.

Global Data Protection Officer P.O.

Box 8010 Zurich, Switzerland

dataprivacy@juliusbaer.com

Dear colleagues

I am in the consulting business all my career. From technical consulting (civil engineering) to digital (software development & testing) to process re-engineering (as we use to call Lean Engineering in the eighties) to Management Consulting, to technology/software based Business Transformation and finally FINTECH Consulting. I accumulated over the years most of the degrees one can have in our field from Project Management to Lean Engineering to Behavioural Analysis to Organisation Studies.

But despite the decades of experience and studies every new breakthrough in our field keeps exciting me. There have been plenty recently. It is a new brave word out there now. Established practices are shaken up and new services come into existence daily. Services that open new possibilities, create new paradigms and affect the way we thought business practices. It all started in the B2C and P2P FINTECH space and fairly recently in the B2B and B2B2B....G2C or B2B2B...2B2C, where G stands for a Government or Public Organisation, B for Business and C for Consumer.

This was not an accident. Innovators choose these fields because, as it is well documented, 9 out of 10 business problems that affect the bottom line derive from the way companies transact, from deficiencies within their business transaction practices.

By default all business functions involve transactions, from their strategy, to internal processes, to their operations. (I mean a transaction as an agreement, communication or movement or all three at the same time, between a “buyer” and a “seller” to exchange an asset for a reward.)

How much one will sell a product or service, to whom, how, in which currency and with what terms, how much he will buy, from whom, how, in which currency and with what terms everything he needs to produce his product or deliver his services, how one will remunerate his personnel in which currency and in which terms and so forth, everything is a transaction and is crucial.

As businesses mature and grow the amount of transactions increases, so does complexity, exponentially actually, due to their interdependence.

To this is constantly added complexity deriving from the environment it operate within, the influences of which can be severe. Businesses are powerless (most of times) to control environmental or market influences. Foreign policies, new laws, commodity prices, currency devaluations, your bigger customer going bust are only few events that can make things worse, that can undermine even the best of sale strategies, operational models or cash-flow projections.

Now you are going to argue that if these problems did not exist most of us would be out of business. This though is not the point I want to make. Where I want to direct your attention is to the way we tend to deal with these issues. What do we actually do to justify our daily rates compared to what we could possibly be doing?

Lets take it from the top.

There are several elements that affect the cost of these transactions. In relation to our customers' revenues the critical three (if we leave aside demand) are complexity, time deriving risk and currency exchange cost. These reduces their profitability between 8 and 83%. Happy to explain how I ended up with these figures even if I bet most of you have similar conclusions over the years.

Why? Because complexity needs management, processes and resources with the trio costing them enormous amounts of money. The mediators (the processors and the Banks) justify their charges with this exact argument.

Finally, currency exchange which similarly to time deriving uncertainty needs to be transformed into manageable risk elements and contingencies which in their turn need management, Insurance and Banks.

The three add up costing businesses $ 24 Trillion per year, with late and non-payments amounting to 4.8 T(European Payment Index) , the cost of Banking (without interest charges) to 18.5 T (Capgemini 2013) and the cost of insurance to anything between 1 and 3 T (ICISA) depending on the markets volatility .

And what we where doing about it when we are called, to try and save the day, by desperate businesses?

Lean Engineering to control complexity, mergers and acquisitions to achieve economies of scale, we design new processes based on our risk analysis were we often include the outsourcing organisations, we propose incentive schemes to reduce the probability of late or non payments capped with some “clever” Trade Credit Insurance and Currency hedging. To wrap it all up we propose often some form of an ERP coupled by supply chain controlling technologies and we tide the lot with some e-invoicing upwards and a bit of e-commerce downwards.

Right? Oversimplified but I believe accurate.

Do we believe that what we were doing will solve their problems long term? NO

We know that in any given transaction there are two parties. Our “influence” unfortunately is affecting only the one so, in the best of cases the end result is, mildly put, uncertain. Add to that the environmental influences I mentioned above and you have an improvement that can be shown only by the use of some well designed KPIs.

By giving expensive “medicines” to alleviate the symptoms do we actually believe we solved the problem? NO

But on the other hand that was not even a moral dilemma. Until yesterday that was all we could actually do or offer based on the theories and the models at our disposal.

Now, though, there are some alternative options. Now we can perform surgery instead of giving medicines to alleviate “pain”. We can tackle directly the root causes of the problems that businesses are facing.

Lets start from complexity.

Complexity derives from the actual amount of transactions and its cost grows exponentially. Over time the methods we used like Process Re-engineering, Lean Engineering, Business Process Management, CRM etc. failed to resolve the problem. They failed because they were not addressing the root cause, the fact that businesses despite their actual interdependence act as if they were alone. Even models followed by Dell or Apple or CISCO where transparency across the whole length of the supply chain is present the results are not the expected.

Take any supply chain you want in any field and start counting:

the impact that one may have on the rest when something out of the norm like a late payment or non payment happens. How many bottom lines upstream are going to be affected?

the amount of transactions happening between them upstream and downstream

the amount of resources needed to manage and support all these

the amount of processes we need to build, monitor and maintain in order to support them

the amount of IT systems we need, their supporting cost and the amount of software licenses we pay

….

There are Trillion of reasons to do something about it.

Let's take time.

Take again any supply chain in any field. From the moment you design your payment terms or you accept your suppliers' ones, risk arises. Risk, the management of which will inevitably lead the business to seek contingencies and reassurance. Do the insurers we use or the Banks, the Law firms, the Debt collectors, the currency hedging etc. were able to solve the problem? NO

Even business clusters that support JIT (just in time) production lines have the same issues.

Businesses keep eroding their profitability and keep adding cost because we are not addressing the root cause, the fact that businesses despite their actual interdependence act as if they were alone.

There are Trillion of reasons to do something about it.

So what can be done?

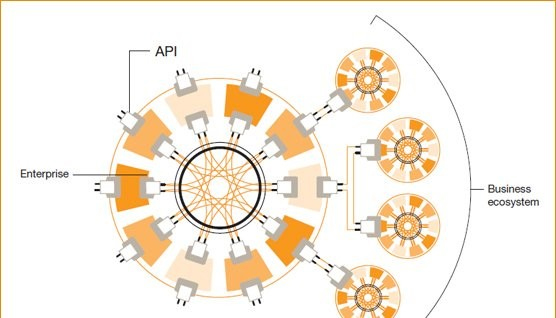

The answer is Two Dimensional Virtual Vertical Integration (2DVVI). The next generation model far beyond what Dell established some decades ago. In simple terms, follow a risk sharing strategy across the whole length of every supply chain a business is participate to. Where ever there are profound shared interests, common goals and inevitable interdependence perceive the chain as one organisation the functions of which are based on intelligent predefined and pre-agreed by the participants algorithms.

2DVVI can create business ecosystems that can act as one organisation WITHOUT affecting the independence of the businesses that constitute it.

Within such an environment where risk is shared none of the above described costs exist. A single transaction at the end of supply or value chain, based on these predefined and pre-agreed algorithms, can substitute all interim transactions, divide the payment to all participating businesses in the chain and update automatically accounting and ERP systems.

The three transactions (B2B plus Business to Bank plus Business to the Insurer) per node across a six levels supply chain, that until now were 15 are transformed into a single one.

As risk is shared time becomes irrelevant. Late and non-payments cease to exist as a notion. Human interaction with accounting systems becomes extinct. Liquidity increases exponentially over time and profitability can increase by up to 83%.

Is it applicable to all supply chains of any length you are going to ask? No, but it is in the majority. Even when applied to a single dimension supply chain with two nodes the economies of scale can improve liquidity by up to 100% and profitability by up to 33%. Yes, economies of scale are now possible to even the smallest of SMEs.

How all this “magical” stuff can happen?

My company is the first representative of a new generation of B2B-focused FINTECH enterprises that try to shake up with innovation-based technology the established ways in regards to the way business transact .

We built over the last two and a half years the infrastructure needed in order 2DVVI to become an easy to implement concept and the tools to complement the vast majority of cases even where cross border transaction occur and not only.

We built modular engines like Chain Payments, Parallel Payments or Enhanced Liquid Payments, Conditional Liquid Payments, Passive Risk Reduction or Private Virtual Banking…. or Bi-Directional Prepaid Cards our own mobile payment system and we keep building. We made last year's science fiction a reality.

However, there are two critical obstacles that we need to overcome:

while you may understand the above described concept we very much doubt that the average businessman does, and second that

we are addressing alone a 24 Trillion market and 100s of millions of businesses, which is mission impossible for any single company

So, we need your help.

We prepared the infrastructure and the tools to resolve once and for all the risk of late or non-payments and to reduce the need Factoring, Invoice Financing for Insurance, Currency Hedging and the rest. We can increase within weeks business cash-flow and increase their profitability. But we cannot do it alone.

We need you to tell the story and implement it.

We are seeking partners around the globe (our initial focus being Europe) to work with us. No consultancy is too small or too big to apply. If you like the idea or even if out of curiosity you want to know more give us a call.

You are not expected you to invest anything except customising your websites and marketing materials.

We will provide you with training and free access to our infrastructure. We will help you in building bespoke solutions if need be and support you technically all the way and at the post implementation stage where we will provide you with 2nd and 3rd line support.

We do not even expect to appear as a service provider if you do not want us to. White label propositions are welcomed.

Most importantly, we are prepared to share with you our profit and we do NOT expect you to do the same.

Interested?

Only a handful of applications will be accepted per country on a first come first served basis.

Multinational Consulting Firms will be considered on a regional level.

Our sites can be found at www.sonicesonice.com, and our platform that makes all possible at https://memeplex.es . You can contact us on info@sonicesonice.com.